New energy technology will make the Baltic Sea Region more crisis-resilient

The current energy crisis is a wake-up call for

the Baltic Sea Region to:

- Tackle the geopolitics of energy at the regiona level and not at the level of the nation state.

- Invest in and improve the coordination of new energy technologies to ease the green transition and make the region more resilient.

- Focus on increasing the interconnectedness of different energy networks to improve regional energy security.

The current energy situation in Europe is being caused by a double crisis and a geopolitical blockage. The long-term climate crisis and the urgent energy crisis have brought green(er) energy to the top of the agenda.

However, they are not working in sync. With gas being the easy choice when cutting CO2 emissions rapidly, the handling of the climate crisis has to some extent produced the energy crisis. On top of that, the increased demand for gas has worsened Europe’s strategic and geopolitical situation vis-à-vis Russia.

Because of extreme weather conditions in 2021 (a cold winter, low wind, a hot summer), combined with the increasing demand for liquified natural gas (LNG) in Asia, post-lockdown industrial gas demand recovery and a green agenda that requires the phasing out of coal and its replacement with the ‘bridge-fuel’, gas, Europe finds itself in a quandary over gas. Geopolitically, the region is in a difficult situation, which is further aggravated by the EU-Russia power play in the gas sector. Empty gas reservoirs in Europe have given the Russian energy giant Gazprom additional leverage to make increased gas supplies to Europe conditional upon the finalization of the Nordstream 2 project, which is technically finished, but has not been certified. In late November, the German regulator suspended Nord Stream 2, increasing the pressure on the gas market. In this context, the energy transition in the Baltic Sea region has the potential to increase resilience in future energy crises and dampen geopolitical dependence by replacing Russian gas with new forms of energy. Its success depends on numerous factors, including the further synchronization of energy networks, new energy infrastructure and technologies (including renewables), improved energy efficiency, and the creation of a common regional gas market. Fossil fuels are envisaged as playing a pivotal role in the regional and European energy supply for decades to come, but with new investments and diversification of suppliers, the geopolitics of gas can be ameliorated.

Continued reliance on fossil fuels

Gas

In the Baltic Sea region, Soviet-era energy infrastructure has kept many countries in a state of dependence on Gazprom even after independence in the early 1990s. This has prompted the diversification of gas supply routes. With LNG terminals opening in Lithuania (in Klaipėda in 2014) and Poland (in Świnoujście in 2016), and with more projects on the way, such as new LNG projects in Poland, Latvia and Finland, or the Baltic Pipe project to send Norwegian gas to Poland through Denmark (to be partially completed by the end of 2022), the Baltic Sea region is gradually breaking away from Russia’s dominance of gas in Europe.

Geopolitically, the region finds itself in a difficult situation, which is further aggravated by the EU-Russia power play in the gas sector.

However, further integration of the Baltic region with EU markets is crucial. One of the key initiatives in the area is the Baltic Energy Market Interconnection Plan (BEMIP) to establish an open and integrated regional electricity and gas market between EU countries in the Baltic Sea region (Denmark, Germany, Estonia, Latvia, Lithuania, Poland, Finland and Sweden). Gas projects such as the Balticconnector between Finland and Estonia and the Gas Interconnector between Poland and Lithuania (GIPL) will link the Baltic and Finnish gas networks with continental Europe, and in the case of GIPL also aid in the creation of a regional LNG market. Increased regional integration will also be achieved through the planned integration of gas markets in Estonia, Finland, Latvia and Lithuania, agreed in April 2020. This will improve the security of the region’s gas supply and provide infrastructure for decarbonized gas sources such as hydrogen.

Clean coal

Gas is not the only fossil fuel that will remain part of the energy mix in the region. Clean coal technologies have been promoted by the International Energy Agency and the Intergovernmental Panel on Climate Change as a potentially key element in the transition to a low-carbon economy.

Coal technologies are especially important to Poland, where over 70% of power generation comes from local coal and where the rapid phasing out of coal could impede economic growth and make Poland even more reliant on Russian oil and gas. In April 2021, a ‘societal agreement’ with the representatives of the coal-miners’ unions extended the timeline for phasing out coal to 2049 and envisaged investments in clean coal technologies.

Despite the EU’s support for R&D in ‘clean coal’ technology and plans for the construction of up to twelve Carbon Capture and Storage (CCS) demonstration power plants between 2007 and 2015, no plans have so far materialized. Potential investors withdrew from the pilot projects, and a billion euros have reportedly been spent.

New energy infrastructure

Electricity networks

Many of the new solutions to the problem of shifting the geopolitical balance in the region depend on the development of alternative electricity grids. Several key electricity infrastructure projects (e.g. Estlink, Nordbalt and the LitPol Link) have improved the connections between the Baltic states and Finland, Sweden and Poland, making them more integrated into the EU energy market.

However, the three Baltic States are still tied into the Russian and Belarusian systems. A plan to synchronize the Baltics with the European network by 2025 is being led by the European Commission and seems to be on track. It is still uncertain whether Russia will hamper the process.

On a smaller scale, the Baltic Sea region also has a high, untapped potential for diffused electricity generation, e.g., in the form of so-called ‘prosumer’ energy, where the production and consumption of energy are mutually dependent and locally anchored. These are especially needed in countries experiencing increasing shortfalls in power supply capacity, e.g. Sweden and Finland.

Nuclear

One of the energy sources with the greatest potential for replacing fossil fuels with stable energy provision and shifting the geopolitical balance in the region is arguably nuclear energy. Jointly with France and other countries from the CEE region (Hungary, the Czech Republic, Romania, Slovakia and Slovenia) Poland is actively pressuring the European Commission to recognize nuclear power as the only non-intermittent, low-carbon energy source currently available on an industrial scale in Europe, and to classify it as ‘green’ in the EU’s taxonomy.

Although Lithuania had to shut down its two reactors at Ignalina nuclear power plant (NPP) in 2004 and 2009, as required by the EU in exchange for membership, the regional trend is going into reverse. Poland recently revived its nuclear energy plans and intends to open its first NPP in 2033, with six reactors to start operating by 2043. Finland is currently doubling its nuclear power generation to supply 60% of electricity generation and to replace coal completely. In Estonia, by 2035 energy startup Fermi Energia is set to develop Europe’s first NPP based on small modular reactors to help meet the 2050 climate goals and increase its energy security.

Offshore wind

While all forms of energy are subject to security concerns in the eastern part of the Baltic Sea Region, a country like Denmark does not view, for example, wind turbines as a geopolitical issue, but rather as a solution to the climate crisis. This needs to change for the geopolitical situation to improve. The overall trend is to scale up to mega-projects. In November 2020 the European Union announced ambitious plans for the further development of offshore renewable energy technologies, with a five-fold increase in offshore wind capacity planned by 2030 (at least 60 GW), and a 25-fold increase by 2050 (to 300 GW). Eight EU countries in the Baltic region have strengthened their commitments to the development of offshore wind.

In countries with high levels of self-sufficiency in energy, like Denmark, much stronger attention to the issue of energy politics, seen as a matter of regional (geo)politics, is required.

Numerous other large-scale projects are currently being developed. Estonia and Latvia are planning a joint offshore wind farm to start operating in 2026; Polish energy companies, together with foreign investors, aim to develop several offshore wind projects to start between 2024 and 2026; and Germany and Denmark have decided to increase their cooperation in offshore projects (e.g. by linking their offshore wind farms at Kriegers Flak and Baltic 1 & 2 via the world’s first offshore interconnector) and renewable hydrogen production.

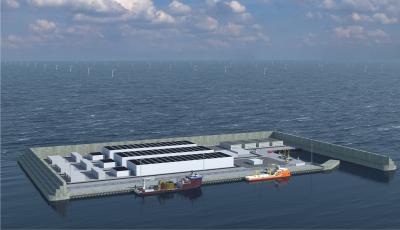

Energy islands

One of the most ambitious mega-projects is Denmark’s ‘energy islands’, planned for the North Sea and the Baltic. While the project is largely being marketed as part of the green transition, the geopolitical impact is tangible. The first energy island in the North Sea will be an artificially constructed island located 100 km west of the coast of Jutland, which will serve as a hub for 200 offshore wind turbines and provide energy for 10 million households. It will be the biggest construction project in Danish history, costing an estimated 210 billion kroner (28bn euros). There are also plans to construct an energy island on the island of Bornholm in the Baltic. In the long term, these energy hubs will operate under the power-to-x model, producing green hydrogen out of surplus wind energy. The current EU Commission sees clean hydrogen as a key solution to decarbonization across multiple sectors. That is good for the climate and the geopolitical situation alike.

Taken together, these various energy projects and technologies have the potential to shift the geopolitical balance in the region. However, apart from the development of technologies and infrastructures, a coordinated regional approach is required. In countries with high levels of self-sufficiency in energy like Denmark, much stronger attention to the issue of energy politics, seen as a matter of regional (geo)politics, is required. With a combined focus on the climate crisis and the region’s geopolitical predicament, energy security may be bolstered in the long term through the green transition.

DIIS Eksperter