How to encourage private sector climate initiatives in Kenya

Climate change is a particularly pertinent issue in Kenya because the country’s economy is highly dependent on its natural resource base (such as agriculture and fisheries), which are sensitive to temperature and rainfall variabilities. As a party to the United Nations Framework Convention on Climate Change (UNFCCC), Kenya must work to mitigate and adapt to climate change.

- Address information gaps on climate change business opportunities, capital demands and uncertainty on the uptake of climate change products and services.

- Describe climate financing as an “incremental cost” in which the cost of climate programmes is not carried entirely by the private sector but subsidised by the government.

- Deploy the preferred incentives for private sector to invest in climate change programmes.

- Create links between climate finance and sustainable development.

This requires significant financial resources. Per the UNFCCC framework, some national climate actions are not expected to receive financing from international financial sources. Therefore, the country must look for innovative ways of domestically sourcing finances for low-carbon development and climate resilience programmes. Kenya has, in this regard, set up and implemented a national climate fund for financing adaptation and mitigation projects, ideally from various sources, including the private sector.

This policy brief explores the legal, price-based, property-based, and information-based incentives for private sector investment and engagement in climate adaptation and mitigation in Kenya. The analysis is based on desk research and 51 stakeholder interviews from identified private sector institutions and industries in Kenya.

The private sector’s need for adaptation and mitigation

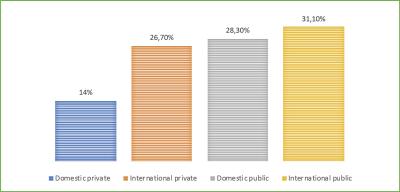

A survey on the climate finance landscape in Kenya shows that out of the USD 2.4 billion invested in the country in 2018, domestic sources contributed 42 percent of the costs of investments. The private sector contribution (both domestic and international) was around 41 percent of the costs.

The private sector remains a key stakeholder in climate change response measures since they are traditionally the most significant greenhouse gas (GHG) emitter. At the same time, their operations, value chains and consumers are also impacted by climate change. Droughts or heavy rainfall can disrupt or increase operations and maintenance costs and raise insurance prices. But in other cases, climate change may also offer investment and employment opportunities in, for example, green and renewable energies. Most private sector investment has been directed to mitigation, such as wind and solar power programmes, because the business model is straightforward. Now the private sector is beginning to engage and invest in adaptation solutions, for purposes of providing lasting solutions to their markets and achieve their institutional climate targets. This would inadvertently accelerate climate-proofing and safeguard the sector’s business operations.

The Kenyan government enacted a climate change law (2016 climate change act, Part IV on duties related to climate change) which obligates private companies to comply with its climate change obligations in achieving low carbon and climate resilient development.

The private sector’s contributions to mitigation and adaptation

The energy and financial sectors are currently the greatest private investors in climate change mitigation and adaptation. On the one hand, the energy sector’s investments lean more on mitigation, focusing on renewable energy sources such as solar, geothermal, wind power and energy efficiency. On the other hand, the financial sector (primarily insurance) serves as an adaptive instrument and incentive to climate projects. This is because insurance de-risks climate initiatives by providing discounts to policyholders, for example, those who protect their property against droughts, floods, and other climate-related disasters. For private companies to sufficiently invest in climate adaptation and mitigation, internal and external financing sources as highlighted in Table 1, need to be well-endowed.

Despite their purported willingness to invest in climate change programmes, Kenyan companies’ biggest barrier to investment is that climate adaptation and mitigation efforts are capital-intensive and offer uncertain financial returns. The companies, therefore, require motivations to invest, that could include financial support, guarantees, tax incentives and control measures as highlighted in table 2. As a result of the uncertainty, most companies prefer contributing to climate adaptation through voluntary corporate social responsibility initiatives tailored to meet the immediate needs of the end consumers. Other challenges include a lack of tailored incentives to fit a particular country context and a lack of defined models on climate investment.

Preferred incentives for private sector climate financing

The mapping of climate finance incentives in Kenya is anchored in a typology framework for climate change adaptation and mitigation incentives, as highlighted in Table 3. This framework presents four categories that include legal-based, price-based, property-based and information-based incentives. Some of these incentives are in use, while some have not yet been adopted in Kenya.

Ranking private sector incentives in Kenya

Legal incentives were the most preferred of all the highlighted incentives. Given that private companies’ core objective is making profit, the companies would benefit from legal instruments (standards, licenses, planning laws, import/export restrictions, enforcement) as a guide for investment in adaptation and mitigation. In addition, legal instruments serve as an anchor for the prioritisation of the other outlined incentives. However, private companies appeal for more knowledge capacity on how legal instruments can be instrumental in developing climate change adaptation and mitigation.

Price-based incentives are the second-ranked preferred incentives in Kenya. Most companies in Kenya prefer subsidies to other price-based incentives.

Information incentives are the third-ranked preferred incentives in Kenya. Of all the information incentives available, education/training is the most preferred information tool, followed by awareness campaigns. Despite the traction in awareness campaigns, companies are keen to secure a substantial investment commitment from the government agencies responsible for the information centres.

Property rights-based incentives are the least preferred incentive in Kenya. This results from a lack of stringent property rights-based policies on intellectual property rights (copyright and patent protection).

Voluntary contributions to the national climate change fund set by the Kenyan government serve as the preferred climate investment option for private companies in Kenya.

Given the availability of various incentives and financing options, private sector companies in Kenya still express their willingness to finance mitigation as compared to adaptation. Private companies say they have inadequate knowledge of applying these incentives in their climate change adaptation and mitigation operations, weak institutional capacity, and mistrust in applying them. Government efforts to tailor incentives to the private sector will increase the chances of uptake, and could thereby reduce enforcement and compliance costs.

- investing in technologies, products, and services that are energy efficient and/or reduce emissions

- investing in technologies, products, and services that focus on adapting to climate change

- a direct monetary contribution to the national climate fund set up by the government

- developing investment strategies that impact both develop climate change and development

DIIS Experts